Eduvation Blog

Wednesday, December 16, 2020 | Category: Eduvation Insider

“Graphic” Forecasts for 2021

Good morning!

Each day this week, more and more of you disappear for winter break – so as we wind down the Eduvation Insider this week, it seems appropriate to look, not at the year in REVIEW, but at the year AHEAD.

Today, I’m going to focus on graphs to help us anticipate what the new year may bring. (A picture’s worth a thousand words, right?)

And although I won’t have time to produce a full-fledged “Ten with Ken Holiday Special,” I am assembling a substantial collection of this year’s higher ed holiday greeting videos…

Pandemic

Maybe it’s because I’ve spent 9 months monitoring the pandemic, but its progress still will determine what our personal and professional lives will look like next year…

Vaccine Watch

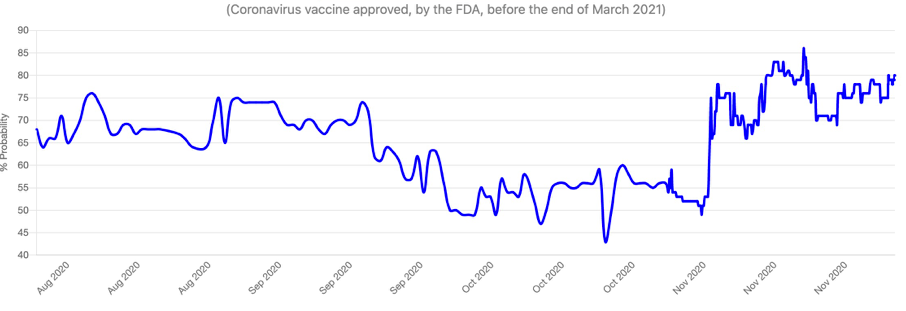

“The elephant in the room” for 2021, says Maclean’s, is “0.125 microns in size.” Even more than the spread of COVID19 itself, the availability of an effective vaccine will determine when (or if) the economy, our society, and yes – our higher ed campuses – can return to some approximation of normal. uLaval economics prof Stephen Gordon proposed this graph of the probability the FDA would approve a vaccine before Apr 2021. (Next, the question will be how quickly we can vaccinate the majority of Canadians. Maclean’s includes several other graphs of vaccine manufacturing, case counts, and more. But today’s Insider isn’t going to focus on COVID19!) Maclean’s

Employment

The digital divide and equity gaps I described yesterday will only be exacerbated next year, if the uneven recovery continues…

Employment Impacts

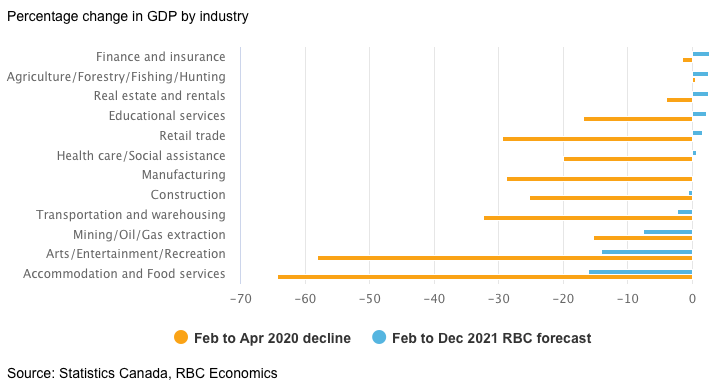

RBC predicts rapid recovery for manufacturing and “higher-value services” sectors (like finance, insurance, real estate education and healthcare), but sectors that rely on centralization and close proximity of people (including accommodation, food service, entertainment, fitness and recreation) may face long-term unemployment through 2022, and the energy and transportation sectors will recover slowly. Displaced service workers will need upskilling to thrive in knowledge worker jobs, and CdnPSE may also play a role in supporting female employees and entrepreneurs, and helping businesses and communities develop infrastructure and skills for a “platform-based economy.” RBC Economics

“The scar tissue of permanent business closures may delay a full recovery until at least 2022.” – RBC Economics, Navigating 2021

K-Shaped Recovery

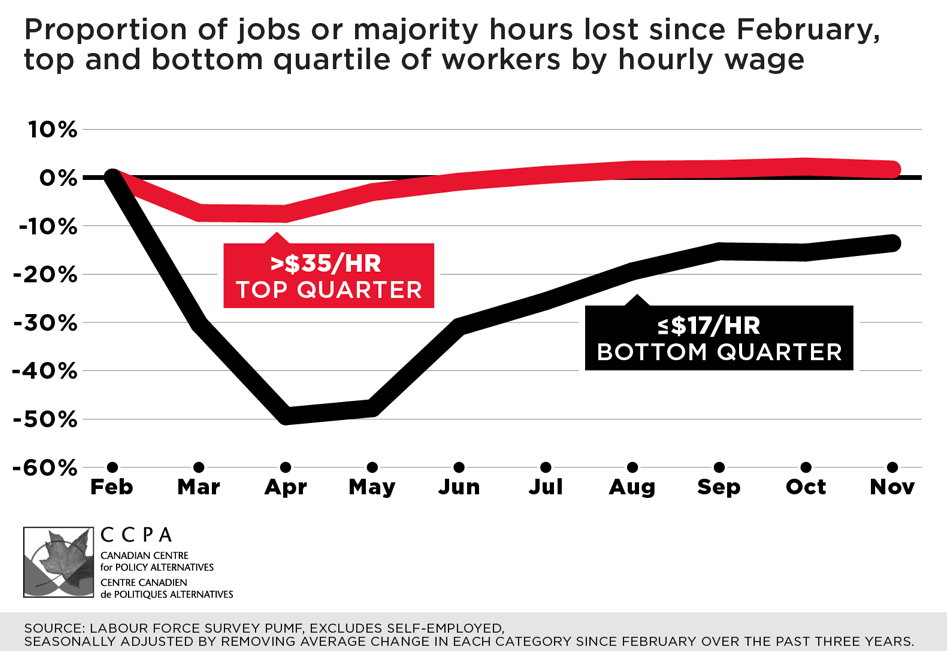

The Canadian Centre for Policy Alternatives points out that the top quartile of Canadian workers (those paid >$35/hr) have actually seen an increase in hours or employment this year, while the bottom quartile (<$17/hr) lost 50% in Apr and May and still haven’t recovered. “Maybe we’re not all in this together.” Maclean’s

Entrepreneurship

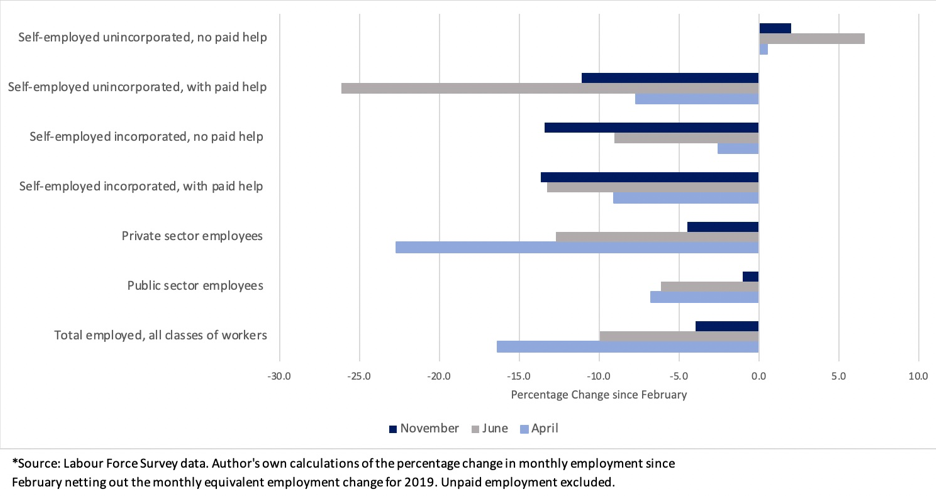

uWaterloo economics prof Stéphanie Lluis proposes that we keep a close eye on the worsening impact of the pandemic on the self-employed. In April, self-employment dropped just 10% compared to 22% in the private sector overall – but by November the employment rate of entrepreneurs and small business owners was still falling, about 13% below its February rate. And of course, the COVID19 recession continues to hit female employees, especially young and racialized women, hardest. “There will be… no she-covery without childcare.” Maclean’s

Immigration

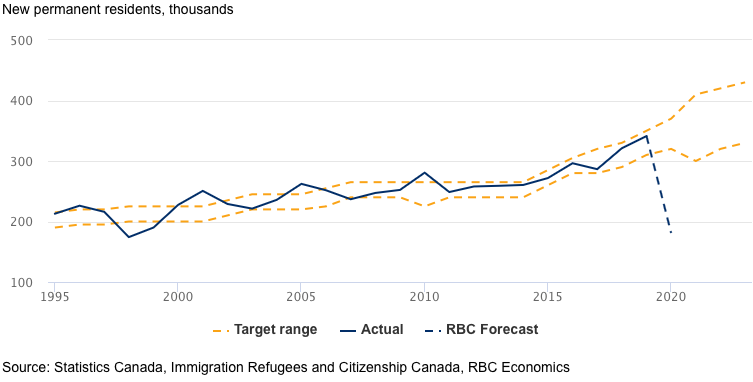

The biggest financial variable for CdnPSE will be how soon, and how fully, international student mobility recovers. That deserves its own in-depth blog, but a related metric from the economists focuses on immigration…

Immigration Recovery

Real estate and education-sector recovery will hinge on the speed with which immigration can resume. COVID19 likely eliminated 150,000 new permanent residents in 2020, and Ottawa has increased targets for the next 3 years in response. RBC Economics

Remote Work

Likewise, I am accumulating an entire day’s worth of content about WFH – but the economists have some disappointing news…

Work from Home

Although 62% of employees say they hope to work from home at least half the time, post-COVID, only 14% of employers say it is likely they will offer remote working arrangements, and 25% say it is very unlikely. In tight labour markets, employers may have to compete for skilled talent by offering WFH flexibility – which may have lasting impacts on commercial real estate and transit. (Already rents and condo prices have “softened” in major cities, while home prices have risen in smaller towns.) Spending more time in their homes, Canadians have focused on “nesting” through renovations, remodeling and more. RBC Economics

Provincial Debt

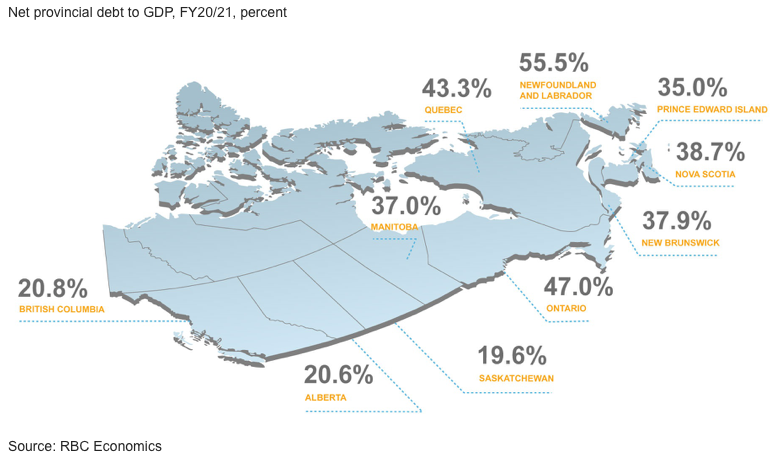

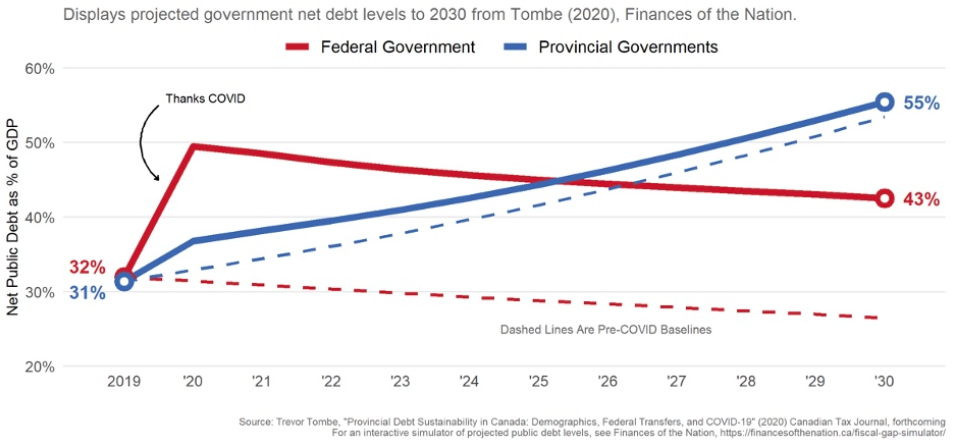

CdnPSE is likely to face new funding pressures next year, as the provinces wrestle with healthcare costs…

Obviously, provincial debts have risen across Canada, as healthcare and pandemic response costs skyrocketed. Debt-to-GDP is projected to be worst in NL (56%), ON (47%), and QC (43%), but it will be above 20% coast-to-coast. Ominously for publicly-funded institutions, “it will take years to put provincial finances back on a sustainable path.” (This can’t be good for CdnPSE funding, obviously.) RBC Economics

uCalgary economics prof Trevor Tombe observes that the $343B federal deficit is actually sustainable, but the projected provincial debt levels will not recover through 2030, as they face mounting healthcare costs from an aging population. “Governments will need to take concrete action,” starting in 2021. The growing debt burden can be expected to drive down the value of the Canadian dollar – which will be a boost to international student recruitment, but a setback for IT and library acquisitions budgets. Maclean’s

Ecommerce

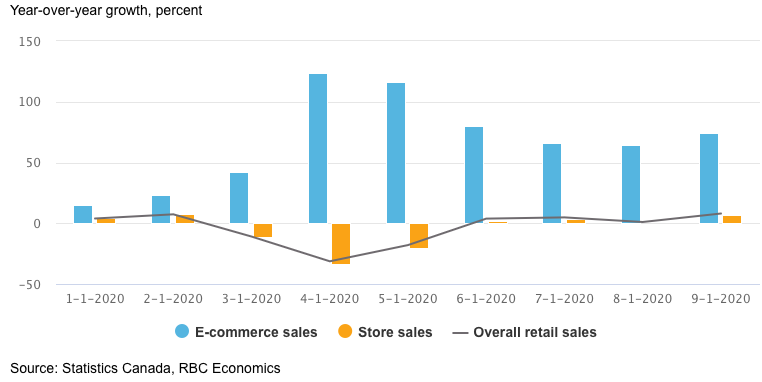

I have a lengthy analogy between retail trends and campus-based PSE which I’ll get to (eventually), but for now, let’s say that the economists’ observations about retailing seem like they might provide us with food for thought…

Although many students and faculty are eager to return to campus once it’s safe, COVID19 has unquestionably prompted all of us to become more comfortable with online platforms for everything from meetings and conferences to banking and shopping. Ecommerce sales surged during lockdown in April, and “a new habit had been hardwired” afterwards. RBC Economics

In particular, more than half of the growth in ecommerce this year has come from bricks-and-mortar retailers pivoting to online sales and curbside pickup. Like retailers, CdnPSE may find it “more important than ever… to up their game in a virtual marketplace” through investments in technology and reskilling of its own faculty and staff. (Again, taking advantage of programs like Ontario’s $50M Virtual Learning Strategy will be part of that.) RBC’s observations about retail may provide an analogy to higher education: pressure will grow for hybrid models, and smaller players may struggle to make the leap. RBC Economics

“The pressure for hybrid models, to compete with both digital platforms and big-box retailers, will also grow. Smaller retailers, already under enormous strain, and often lacking the necessary capital, could struggle to make the leap.” – RBC Economics

COVID on Campus

CdnPSE reported 4 more cases of COVID19 yesterday…

Durham College reported a new case of COVID19 at its Whitby campus yesterday. (Total of 37 this fall.) DC

Western U’s UH reported 3 more staff cases of COVID19 yesterday, and a 16th death. The totals for the hospital outbreak are elusive, but CBC reports 159. CBC

2020 PSE Holiday Vids

So far, I’ve collected 300 higher ed holiday greeting videos published to YouTube in the past few weeks. You can check out the full playlist on YouTube here. (And please do let me know if I’ve missed one you’re especially proud of!)

This Friday, to cap the week before we take a 3-week hiatus, I hope to share some of the very best in a blog entry. Stay tuned!

Thanks for reading. Be safe and stay well!

All contents copyright © 2014 Eduvation Inc. All rights reserved.